Short selling | 🥇 The Complete 2020 Guide

Short selling is a very common practice on the stock exchanges and involves the sale of assets that are not in your portfolio, that is, the trader has not yet bought the stock. You can also hear its term in English, which is called short selling.

Even though it seems very simple, most people still have doubts about how this practice works. But in this article we will talk about what you need to know and put an end to doubts once and for all.

Simple and quick translation of short selling step by step

Start in the world of trading, you should just follow these simple steps:

- Step 1: Choose the right broker for short selling

- Step 2: Open / Register an account (We recommend Avatrade)

- Step 3: Confirm your identity

- Step 4: Deposit funds

- Step 5: Start trading

index

What is short selling

A short sale takes place when a Trader borrows through a broker, who usually owns the securities of another trader. The brokerage itself rarely buys the securities to borrow the short sale.

The original owner does not lose the right to sell the securities while they are being traded by the one who "lent" them, as the broker usually holds a large number of these securities to various investors who, as these securities are cumulative, can be transferred to any buyer .

In most market conditions, there is an immediate demand for securities to be loaned, held by mutual funds, pension funds and other traders.

How to operate short selling

There are several ways to operate a short sale. The most basic method is called “physical” short selling, which involves lending assets and selling them. After that, Trader will buy the same amount of the same bonds to return to the trader who borrowed it.

If the price falls from the moment of the initial sale until the moment the shares are repurchased, the trader will have made a profit equal to the difference. Otherwise, if the price has gone up, the trader will have a loss.

The short selling trader usually pays a fee to be able to borrow the assets and return the creditor as a way to compensate the owner for not having made the sale, since he lent it.

What is short selling shares

As we have already mentioned, selling shares short is when you borrow that share from another investor on the same platform and can be traded by you, paying a fee to the trader from whom it was lent.

It has a set deadline and land or not to close automatically. It all depends on the asset and platform you choose.

Shorting Shares

After you choose which stock you want to "borrow" and see if it is available, of course. Generally, platforms already make available which shares are available for short selling.

After having studied the forecast of the shares, you are leasing the sale and waiting for it to enter into trading. Making a profit, the fee is discounted and sent to the original owner.

Simple and quick steps to start short selling

Step 1: Choose a good trading broker platform

Choosing the ideal broker is just as important as choosing which stock you want to short sell. There are many options, we will list the ones that are best recommended on the internet.

Avatrade

Avatrade is a highly praised online Forex broker on the internet. It originated in Ireland but is regulated in all countries where it operates.

- Quick Access

- High profits

- Asset varieties

- Takes the first retreat

eToro

eToro is also an online broker but, its platform, its functionality stood out among the others. Your credentials are real and have authorization in several countries.

- Simple Interface

- Quick registration

- No withdrawal fee

- Asset Variety

Documentation

IQ option is an online binary options broker very famous for its speed. It was also one of the first to offer a demo account, where you can practice without risk.

- Easy withdrawal

- Asset options

- No deposit fee

- Earnings rate

XM

XM is a broker that offers the possibility to trade different types of currencies, stocks and bonds. Regulated in more than 196 countries, it is also among the darlings.

- Transaction speed

- Details of the negotiations

- No fee

- Limited service

How to start short stock sales?

Let's take a simple step by step, to show you how easy it really is to enter the market (we recommend Avatrade).

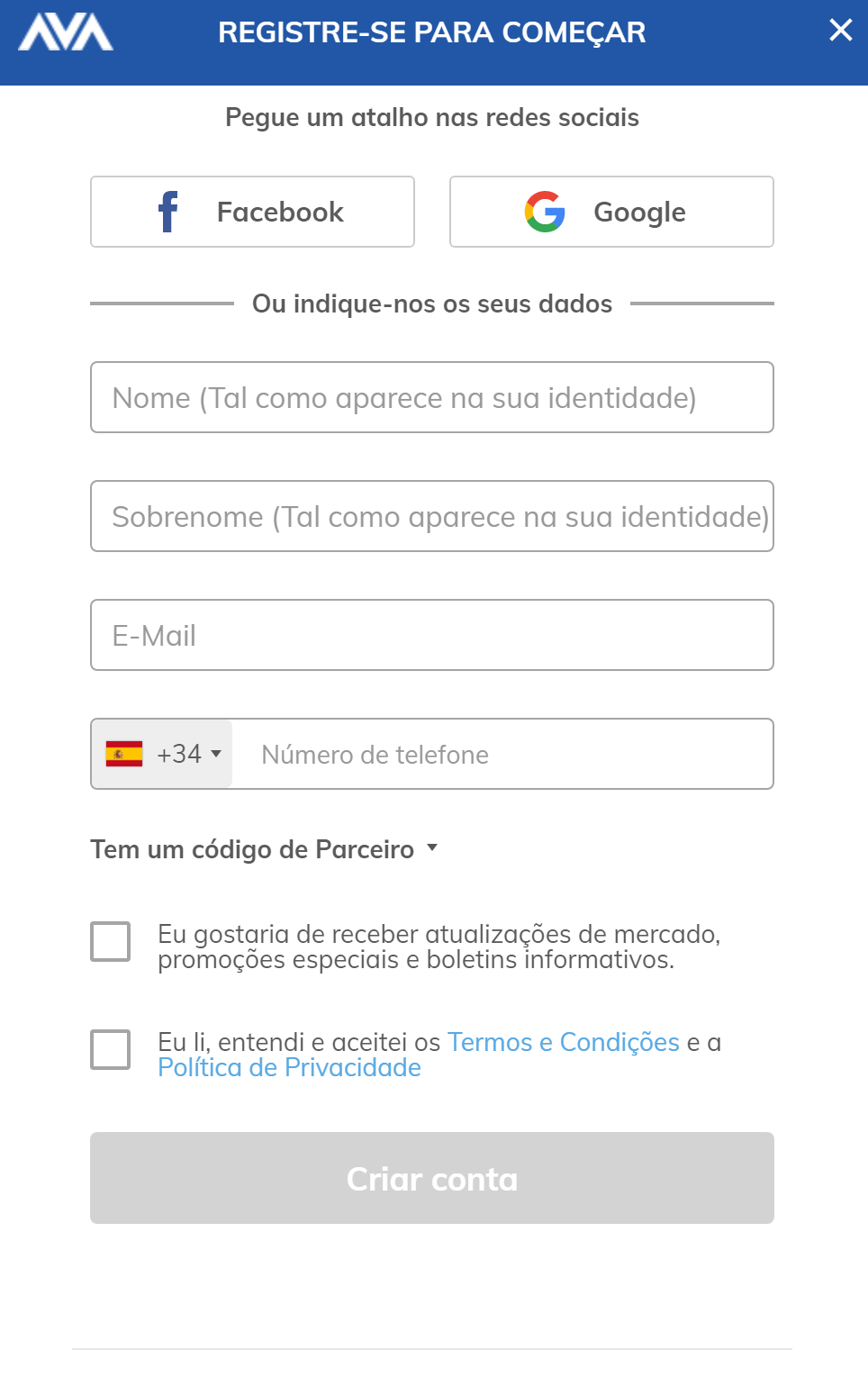

Step 2: Opening an account

Access the website AvaTrade and click on “Create an account”

Enter an email and set a password and click on “Create my account”

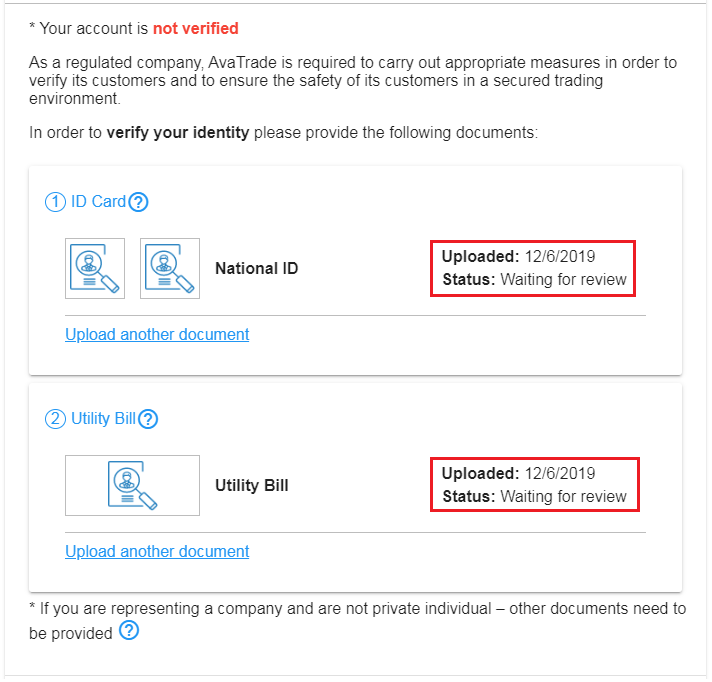

Step 3: Identity verification

Provide your name, phone and address. Confirm everything and that's it, your free account has been created.

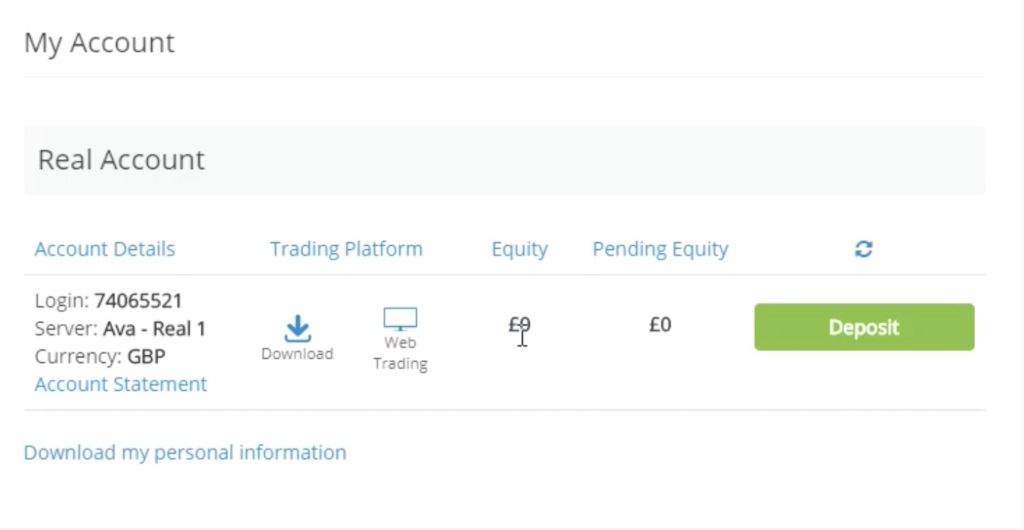

Step 4: Depositing funds

Make your first deposit

After your first deposit, click on the part offering short purchase and select your stock.

Step 5: Start trading

Click on the chosen stock and you're done, you can start trading.

As soon as you get used to overdraft trading, you can enter another type of investment. There are strategies that work in different ways and you can have more options for trading.

As soon as you get used to overdraft trading, you can enter another type of investment. There are strategies that work in different ways and you can have more options for trading.

Day trade short selling

Day Trade is a form of trading where the Trader opens and closes in the same trade the same asset in the same position. These assets that are available for purchase and sale in the form of Day Trade trading are only those that the platform already makes available at the moment when negotiations are opened.

When the trading session ends, the Trader must also finalize his open positions, that is, he will have to sell or buy the assets he has made available.

Short sale of PUT

A short put is a type of strategy in which the owner of the asset is allowed to set a put option price for a specific asset, by means of a contract. But this contract has an expiration date.

The owner, or owner, is the one who bought the put and made it available for the day trade. It defines price, fees and time. If you do not set time, the platform terminates the contract at the end of daily negotiations.

BTC short selling

In order to “borrow” BTC shares, first of all, you need to see if the chosen broker has in your asset letter. If so, you can choose between normal trading or the short selling BTC asset.

In some brokers, this rental can be automatic and in others it needs to be activated by e-mail to the broker or the owner of the BTC. Automatically, everything goes in one click, but it is more difficult to negotiate directly with the owner of the asset in relation to amoreco and fees.

By email, you have a chance to bargain and even agree on other rates and availability times. But not everyone responds quickly and remember, the price goes up and down all the time.

Short sale Bovespa

The Bovespa index, also known as IBovespa, has the best average indicator available for B3 trades (Brazil, Bolsa, Balcão).

- With this provision, there are more or less 450 different securities, not all available for short sale. It is necessary to look, before the opening of the negotiation, which will be available and try to predict the growth.

- Short selling Clear

- Short selling Clear, Trader has the ability to order sales or purchase orders depending on the availability of the asset in the market.

- The advantage is that the futures and cash market shares can be traded. If the asset value is low, the platform will trade for the Trader, after that, it has the risk calculation, which will analyze and predict the growth potential of this acquired stock.

Short selling XP

Short selling with XP has the advantage of having a very fast leverage system, calculating the real risk of each stock, compared to the current market.

It also has “paid custody”, where the Trader makes all his shares available and XP itself goes after “buyers”, closing the deal with the largest offer.

Bitcoin short selling

Short selling is not so widely used due to the fact that the asset must fall in order to acquire and gain from leveraging the asset.

As Bitcoin is more volatile than real stocks, it just needs to have some experience.

The advantage is that you can keep your sales operation open longer, as the negotiation time is longer than that of other assets.

Conclusion: Trading in 2020?

Even if this limited term has a certain risk, this is true for all investments. It is worth more for those who have a little more experience, but nothing prevents, with a little study, the beginner start directly with short selling.

Certainly the speed of return is higher, but like any investment, it is up to the tree to know what it can and if it is worth investing. In the end, the risk is only yours.

Look for the broker that best suits your style, the one that, for you, was the one that most covered your needs and in the end, invest with clarity.

FAQ

How are operations short?

Short trading is selling an asset that you do not own in the hope that its price will go down and that you can close the deal at a profit. It is also called going short or taking a short position.

What are long and short positions?

A long position is a purchase of a financial asset with the expectation that it may increase in value in the future. ... Conversely, taking short or counter-long positions is known as taking a short position.

What are the positions on the stock exchange?

A stock position is the purchase or sale of a financial asset with the expectation that it will be traded again in the future ... In other words, the person or institution takes a position on an asset in order to later do the opposite transaction for make a profit.