Shares below 3 reais | Check out the best ones | 🥇Complete Guide 2021

Investing in stocks is certainly a gamble many people are making. At the end of 2020, B3 released a study showing that between 2019 and 2020, there were more than 2 million new investors on the stock exchange. The survey revealed that young people (up to 32 years old) without children and with an average income of R$ 5 are the average profile for this new crop. In this context, buy shares below 3 reais can be a good way to get started in this medium of equity investments.

Keep reading to know everything about the subject.

index

Is it safe to invest in shares below 3 reais?

Just like any other investment in the financial market, stocks below 3 reais present risks and opportunities. The good news is that these lower assets tend to show few downward swings – after all, they are already priced very cheaply.

This, for some investors, represents greater "comfort" to be able to put little money and try to collect a return, however small, such as in shares below 2 reais. To have more security, it is important to evaluate the company's history and what are the plans for its recovery. Remember that investing is a risky activity, so don't invest beyond your financial capabilities.

In addition, B3, since 2015, has regulated that all publicly traded companies that have shares below 1 real they need to present an action plan to their investors. This attitude gives more security to those who want to invest in cheap assets. If you're prepared to invest a little more, it's also worth studying investments in shares below 10 reais.

Stocks on the stock exchange with values below 3 reais

We know that in times of instability and economic crises, maintaining caution is essential. But taking some more responsible risks can start a good investment strategy, for that, stocks below 3 reais can be a good start.

The cheapest assets are those that belong to companies that are going through a delicate period, whether because of a financial crisis, problems with their image, investigations and allegations of corruption or even companies that are filing for bankruptcy or restructuring. For this reason, they ended up losing a lot of investors, and their cost became cheaper, being then with a “discount”. It is at this time that many ask themselves how to buy stocks. Therefore, it is essential to study which stock you want to buy, and whether it is in a period of recovery or not, be it a stock below 3 reais or any other stock.

Below, learn about the main actions below 3 reais today:

- Saraiva (SLED4) - BRL 0,53

- Dommo (DMMO3) - BRL 0,88

- Hi (OIBR3) - BRL 1,08

- Recrusul (RCSL4) - BRL 1,64

- Hi (OIBR4) - BRL 1,81

- BR Brokers (BBRK3) – R$2,06

- Bombril (BOBR4) - R$ 2,14

- Santanense (CTSA4) - BRL 2,32

- Marcopolo (POMO4) - R$ 2,67

- Technos (TECN3) - BRL 2,79

- Tecnosol (TCNO3) - BRL 3,00

August 2021 data

Investing in stocks below 3 reais: is it worth it?

Starting to invest with shares below 3 reais is worth it for those who want to invest little by little to gain confidence or even for those who don't have much money to invest. That way, even with a lower value, like only 3 reais, you are already investing in stocks.

Starting to invest with shares below 3 reais is worth it for those who want to invest little by little to gain confidence or even for those who don't have much money to invest. That way, even with a lower value, like only 3 reais, you are already investing in stocks.

Low risk, little investment and chances of asset appreciation thanks to the economic recovery that Brazil is experiencing are some of the benefits of investing in shares below 3 reais. For this, analyzing the economic scenario and also the history of the company in which you want to invest is fundamental.

This is perhaps one of the best times to invest, and that is why we have separated in this content the main actions that we are always keeping an eye on the financial market that, despite being considered “penny stocks” can still bring a very interesting income, especially if you are interested in carrying out day trade. We remind you that it is essential to analyze the company's history to understand if it is in a growth trend. Thus, avoiding losses - however small they may be.

Despite the challenging scenario, many companies that remained healthy (despite the great challenge brought by the COVID-19 pandemic) are beginning to show growth trends in their results compared to the previous year. Therefore, it may be interesting to invest in stocks below 3 reais before they take off.

There is also a market logic that periods of crisis are the best for starting a new investment. After all, it is possible to buy stocks at more competitive prices and wait until an economic recovery makes them appreciate. This is the logic behind the actions below 3 reais that we will see in this content.

Shares below 3 reais 2020

Some shares below 3 reais may increase in value. Therefore, understanding which companies were in this situation in 2020 is a way to identify which ones are in a growth situation. Most importantly, penny stocks do not pose such great downside risks to investors, at least not in very significant amounts. Some investors take advantage of shares below 3 reais to perform day trading.

Even so, as we will see later in this content, some companies manage to strengthen their actions and, even in a delicate scenario, show growth in the value of assets.

Below, we list the shares below 3 reais in 2020 to help you choose which ones to buy:

- Hail (SLED4);

- Dommo (DMMO3);

- Hail (SLED3);

- Hi (OIBR3);

- Recrusul (RCSL4);

- PDG (PDGR3);

- BR Brokers (BBRK3);

- Santanense (CTSA4);

- Tecnosol (TCNO4);

- Bombril (BOBR4);

- Living (VIVR3);

- Technos (TECN3);

- Othon Hotels (HOOT4);

- Marcopolo (POMO3).

Some of these you could see are no longer on the current list, because many of them increased in value in 2021, such as Hoteis Othon and Viver. Which demonstrates an optimistic scenario that even the cheapest stocks can appreciate and make a good profit.

Step by step to invest in shares below 3 reais

Starting to invest in shares below 3 reais is easier than you can imagine. You don't need much, just find a good broker, that is safe, to make your investments without fear. In addition, it is always important to remember that the choice of stock that you want to invest needs to be thought out carefully, and a good analysis of the asset's history can help you.

To find the best broker and start your investments, we can help. We analyzed comments and feedbacks and came to the conclusion that the eToro It is the best tool for novice investors as well as more experienced ones. Overall, the platform is very safe and simple for traders. Next, check out the step-by-step guide to start investing without fear.

Step 1: Create an account on the eToro website

Creating an eToro account is very easy and you can do everything directly from your computer screen or mobile phone. On the website's home page there is a button inviting you to "try" the tool. Registration is free and very simple to be done.

You can register either manually or using your Google or Facebook account login details. If you already have the registration, just click on "Enter", provide your information and start browsing. The data required to register for free at eToro are:

- Full name;

- Email address;

- Your preferred currency (Dollar, Euro or Real);

- If you agree with the terms of contract and privacy policy.

Step 2: Complete your profile in the tool itself

In order to offer more agility and full understanding of how the tool works, eToro offers the option of completing your profile, so you have more information about your investor experience to make the best investments.

When you finish your profile, you can start making a deposit to start your investments. For this, it is important to know the payments page.

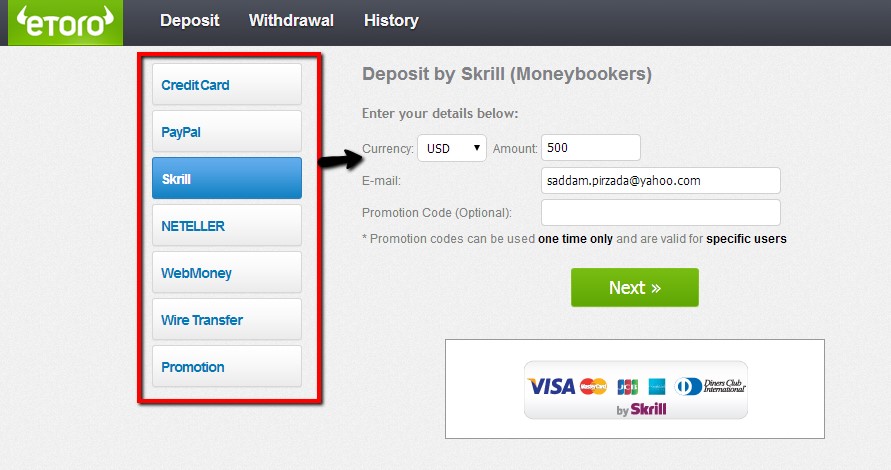

Step 3: Make your first deposit

To start trading you need money, right? And if you want to buy shares below 3 reais and invest little, no problem. The minimum deposit required is quite low (you didn't read that wrong, that's it!).

From the deposit, you can activate your virtual wallet. We suggest starting with a value ranging from R$40 to R$200 to understand the model and gain experience.

eToro accepts various types of deposit to make your experience much more convenient. Among the available payment methods, we can mention:

- Pix

- Wire Transfer

- Ticket

- Lottery

- Neteller and Skrill

- Itaú, Banco do Brasil, Bradesco and Santander

- AstroPay and Safety Pay

- Perfect Money

- Bitcoin and Litecoin

- Jeton wallet

- Advcash

Ah! And you can even count on the “eToro Coupon” to make your transactions. After that, just start your journey in the financial market.

Step 4: Start investing

This is where the magic finally happens. Through the tool's dashboards, you can start trading in tradings.

It is noteworthy that eToro has practical policies to ensure equal conditions for all users, so that everyone has opportunities that adhere to the individual investor profile. The brokerage also has a trading app and a mobile-optimized interface, for those investors who prefer to operate with a mobile phone.

Shares below 3 reais 2021 can appreciate?

The good news for those who want to invest in cheap stocks is that there are several possibilities for them to appreciate. And this is not such an abstract thing. In fact, this is what is expected in an economic recovery scenario like the one we are witnessing.

The good news for those who want to invest in cheap stocks is that there are several possibilities for them to appreciate. And this is not such an abstract thing. In fact, this is what is expected in an economic recovery scenario like the one we are witnessing.

Many companies have recently dropped their stocks during the economic downturn driven by the closing of trade during the pandemic's most dramatic months. Cheap stocks, called penny stocks are usually one of the best actions for day trade. This is because they are generally shares of companies that are in financially sensitive situations or that have been questioned about their reputation. With the fiscal and economic recovery, the appreciation of many shares comes as a consequence.

It is easy to check if a stock is showing an improvement in its market value through the IPO (initial public offering). Another nice tip for those who want to start investing with little is to look for Startups that are starting their journey in the financial market and are aiming to go public on the stock exchange. Often, many of them have innovative ideas that they can add to very quickly.

These companies can have greater security and profitability expectations, because, unlike others that are facing bankruptcy or even reputation problems, startups do not have a high asset value as they are in the early stages of their financial journey. But, if the chosen startup follows the roadmap and planning, usually hits its internal goals and the company is in a strong trending segment, it is certainly an excellent return on investment bet.

FAQ

What are the best stocks below 3 reais to invest?

There are many stocks below 3 reais that are interesting for investors. Among the Brazilian actions, we can highlight the actions of OI (OIBR3 and OIBR4) and Saraiva (SLED3).

Are there shares below 3 reais that appreciated today?

Yes, there are several examples of companies that started with shares below 3 reais and that today are worth a lot. One of the best examples is the case of Magazine Luiza, whose shares started trading at a cheaper price and today MGLU3 shares are traded above 20 reais.

Are there shares below 3 US reais to invest?

There are several stocks below 3 reais on the main American stock exchanges, which are the NYSE (New York Stock Exchange) and the NASDAQ, which specializes in technology company assets. Some examples are the shares of Gran Tierra Energy (GTE) and Two Rivers Water & Farming Co (TURV).