Shares below 20 reais | Check out the best |🥇Complete Guide 2021

Investments in variable income are proving to be attractive options among Brazilians. If this bolder trading profile was underexplored before, this is now a thing of the past, and new investors are betting mainly on stocks. A new, younger and more connected audience is starting to follow the shares below 20 reais to deposit your money.

We think it is pertinent to present to you, who already invests or is willing to invest, the shares below 20 reais. Check out the main ones below!

index

What are the shares below 20 reais listed on B3?

many wonder how to buy stocks even with a normal salary. In fact, buying stocks is not something unaffordable. Quite the contrary: there are shares of all values (even under 1 real), just search for the best option for your pocket. Below, we separate promising companies that have their shares below 20 reais for you to know. We always remember that it is important to assess the company's stock scenario in the long term, study the history and see if it is on the rise to make a decision if it is in fact worth it.

- Cury (CURY3) - BRL 8,24

- Minerva (BEEF3) - BRL 8,35

- Moura Dubeux Engenharia SA (MDNE3) – R$ 8,58

- Dotz (DOTZ3) – BRL 9,05

- BR Malls (BRML3) - R$9,25

- Mobly (MBLY3) - BRL 11,47

- TIM (TIMS3) - BRL 12,22

- Gerdau (GOAU4) - R$ 13,02

- CEMIG (CMIG4) - BRL 13,24

- MRV (MRVE3) - BRL 13,67

- B3 (B3SA3) - BRL 13,94

- GetNinjas (NINJ3) – R$16,85

- ModalMais (MODL11) - BRL 17,15

- Zenvia (ZENV) - BRL 17,85

- Usiminas (USIM5) - BRL 18,50

- EDP Brasil (ENBR3) - BRL 18,61

- Magazine Luiza (MGLU3) – R$ 19,07

- Sanepar (SAPR11) - BRL 19,75

Data from August 28, 2021*

Some of these shares belong to startups like Mobly and GetNinjas. These companies recently entered the IPO and are already presenting themselves as very promising stocks worth keeping an eye on.

Another highlight on our list is the company CVC, which had its shares “downgraded” because of the Coronavirus pandemic. Before 2020, the company had shares above R$ 50. It had a drastic drop and now, with the advance of vaccination in Brazil, it is showing an increase again.

Step by step to invest in shares below 20 reais

You've already realized that investing in stocks is nothing out of this world. The increase in shareholders is also a reflection of the reduction of bureaucracy in the process and the ease of investing through brokers. One of the best, according to the opinion of our readers and experts, is the Binomo, which offers all the infrastructure and security to make your investments.

This is probably the best time ever: define how and where to make your investments. We've brought you a step-by-step guide on how to invest in Binomo because we believe it can offer you everything you need to start trading on the stock exchange and still have a simple and intuitive view. Check it out below!

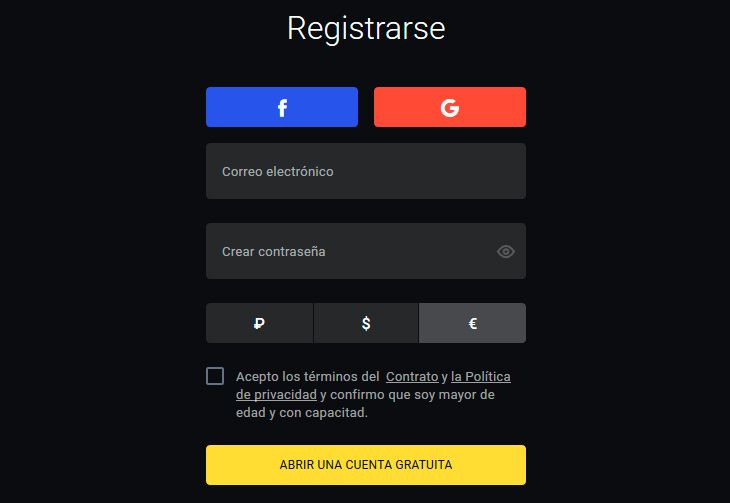

Step 1: Create an account on the Binomo website

As soon as you enter the Binomo website you will come across an invite button to “Try” the tool. Upon clicking, a registration page is displayed for you to register. There is little data that is required and you still have the option to fill in manually or using your Google or Facebook account information.

We list for you the data that is requested:

- Full name;

- Email address;

- Preferred currency (Dollar, Euro or Real);

- And finally, if you are aware of and agree to the terms of the contract and privacy policy.

If you already have an account, just log in with your registered login and password.

Step 2: Take the tool tutorial

If you have never had contact with trading on the Exchange through a broker, you will be happy to know that Binomo offers an automatic tutorial to show you how to trade on the trading, based on your experience and your investor profile.

This is a strategy that offers more transparency so you can operate more comfortably and quickly. After finishing the quick training, you will be directed to a page that contains your “digital wallet” and the data to access the demo and real accounts.

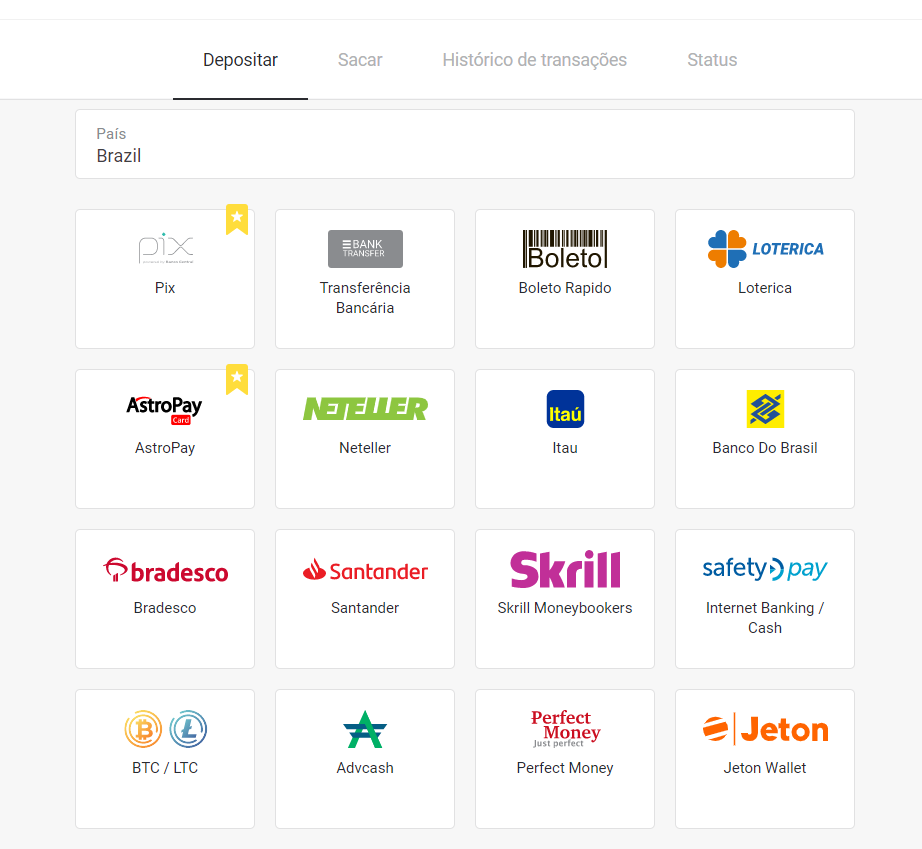

Step 3: Make the minimum deposit

Creating an account at Binomo is free, but to start trading you need to make the minimum deposit in your virtual account to start trading in the tradings. The minimum necessary to put in the account is R$40 and you can already activate your portfolio (that's exactly what you read, with only R$40 you can start trading in the financial market).

A tip we give is to start the investment with a not so high value, ranging between R$ 40 and R$ 200. So you can understand how the platform works and as you feel comfortable and familiar, increase the amount. In addition, another advantage for those who open an account with this broker is the possibility of having the “Binomo coupon”.

The best part of investing with Binomo is that you have a series of very flexible options (from the most modern and technological methods available in the financial market to more traditional options) for depositing. Below, we list for you the options to make a deposit in your virtual wallet:

- Pix

- Wire Transfer

- Ticket

- Lottery

- Neteller and Skrill

- Itaú, Banco do Brasil, Bradesco and Santander

- AstroPay and Safety Pay

- Perfect Money

- Bitcoin and Litecoin

- Jeton wallet

- Advcash

Step 4: Start investing

As soon as the money falls into your Binomo virtual wallet, it is possible to start the trading stage in the trading companies. Another guarantee that Binomo offers are some policies that aim to ensure that all users have equal opportunities. In addition, investments adequately follow the investor's individual profile.

Is it safe to invest in stocks?

This is a very common question in investors' minds: is it safe to make this purchase? Will I lose money? Before answering this, it is worth understanding the change that has taken place in the financial market recently.

This is a very common question in investors' minds: is it safe to make this purchase? Will I lose money? Before answering this, it is worth understanding the change that has taken place in the financial market recently.

According to a study carried out by B3, the Brazilian Stock Exchange, the number of individuals has grown considerably in the last three years. Until 2018, the number of individual investors on the Stock Exchange was around 814 thousand. In 2020, the mark reached was 3,2 million. In the first half of 2021, this number increased by 17%, reaching the mark of 3,8 million investors.

The interest in investing in shares came at a somewhat troubled time, at the height of the Coronavirus pandemic in Brazil. The volatility in the financial market made the challenge of investing even greater, but this did not intimidate Brazilian traders, what the data shows is that the effect was opposite.

What could be seen is that there was a process of change in the financial market. If before the majority audience was more experienced men, today that has changed, and a younger audience (and women too) started to invest more in B3. The average profile of investors today is in the 32-year-old group with an average income of up to R$5. In fact, many of these investors are also looking for other investments, such as best actions for day trade.

Another highlight that caught the attention was the growth of people looking for investments in variable income, as they believe that to earn more it is also necessary to take on more risks. The increase in equity investment shows this intention.

The thought that it takes a lot of money to start investing in the Stock Exchange is in the past. Today, many investors even carry out day trade easily. Today, new shareholders know they can count on more affordable options that pay off in the medium and long term. Thus, it is possible to say that it is safe to invest in shares below 20 reais.

Is it worth investing in shares below 20 reais?

Shares below 20 reais are average values that can represent a company's agile climb. It will depend a lot on which one we are talking about, the segment in which it operates and the history of market values.

Shares below 20 reais are average values that can represent a company's agile climb. It will depend a lot on which one we are talking about, the segment in which it operates and the history of market values.

An example that we can cite a share below 20 reais is Magazine Luiza (MGLU3). This is one of the most beloved companies among the young public, and for that reason, it promises to move the financial market. Although, at the moment, the company is showing a drop in its shares, it is a very modern company and attentive to current trends.

This year alone, in addition to the positions of CEO Luiza Trajano, the company also invested heavily in technology for retail, and today it is considered one of the largest marketplaces. Therefore, it is worth paying close attention to the volatility of Magalu's shares.

Another company we can highlight is BR Malls (BRML3), which is planning to open more than 240 stores by the end of this year. The company's shares suffered a drastic fall with the arrival of the pandemic, but with the advance of vaccination and also the reopening of trade, it may be a good bet to invest.

Many retail companies are managing to re-establish themselves now with the heating of the market and the fiscal recovery. With the reopening and advances in vaccination and the approaching end of the year, the actions of retail companies are very attractive for those who want to invest in the medium and long term.

A smart tip is to keep an eye on companies that are standing out positively in the media and betting on innovation and new technologies to operate their businesses. After all, this has already proved to be a true trend for 2022 and there are many shares below 20 reais today that can increase at any time, especially those that had a drop due to the coronavirus pandemic.

FAQ

What are the shares below 20 reais that pay dividends?

There are several shares below 20 reais that pay dividends. It is worth checking out some of them such as Itaú SA (ITUSA), Banco PAN (BPAN4), BR Properties SA (BRPR3) and Oi (OIBR3).

Are there shares below 20 reais that appreciated?

Yes, there are many companies that started with shares below 20 reais and that today have appreciated a lot. Many are familiar with the case of Magazine Luiza (MGLU3), which started on the Stock Exchange with a lower price and appreciated a lot.