Shares below 2 reais | Check out the best |🥇Complete Guide 2021

Starting to invest money seems like something out of this world. For some, it is common to associate investments with something aimed at people with a lot of purchasing power, however, the thinking is wrong and outdated. In this content, we will show you shares below 2 reais na B3 – the Brazilian stock exchange and world reference – for those who want to enter the financial market, but with some caution.

Of course, investing money is always a risk to be taken. This is because the financial market is a very volatile environment. The more money that is invested, the greater the chances of an increase or loss. Even so, it is possible to consult and understand which stocks are likely to appreciate.

Here, you will know the stocks below 2 reais, but it is important to make a careful analysis of which stock you are willing to buy, after all, the market changes all the time.

index

What are the shares below 2 reais currently listed on B3?

There's no denying it: even when it comes to cheap stocks, they are subject to change, whether it's a raise or not. B3, Bolsa de Valores do Brasil, is one of the largest stock exchanges in the world and concentrates a good part of financial transactions – with higher and lower market value.

Below, we select the shares that are listed on the stock exchange with values below 2 reais:

- OIBR4;

- RCSL4;

- OIBR3;

- SLED3;

- DMMO3;

- SLED4.

August 2021 data

Is it safe to invest in shares below 2 reais 2021?

Shares that cost less than 2 reais are called “penny stocks” in the financial market. These are generally low-cost shares belonging to companies that are experiencing financial difficulties, or reputation problems and, depending on the case, may even be in judicial recovery – and for this reason, the share price was lowered.

These are also cases in which companies have generally lost many investors and, for this reason, buy shares it can represent a risk, but also an opportunity should these establishments resurface. The analysis of the company's scenario, following the news about the brand's history and even knowing if it has a restructuring plan can guide to decide which one is worth investing or not.

For those who want to start investing in stocks, penny stocks can be good options to get experience and low risk in the financial market. Still, we can always do a good financial analysis – which is what many experienced investors choose to understand which stocks below 2 reais are trending upwards.

Are there any cases of companies that appreciate even with such low stocks? Sure enough. An example of this is the company Viver (VIVR3) which closed 2020 costing a little more than 1 real and today it is around R$3,27.

Another example that we can also give was the case of the company Technos (TECN3), which closed 2020 with shares budgeted at R$1,27 and today, it is worth R$2,78.

Although growth is shy, it is an optimistic scenario that shows that some companies, even those with very low prices, are able to recover in the medium and long term. That's why keeping up with the variations and market of these companies is really the key to discovering and choosing which one to invest in.

In addition, since 2015, B3 has been taking action in relation to companies that have very cheap shares (below 1 Real) for 30 consecutive trading sessions. When this happens, companies are required to present an action plan to investors.

Step by step to invest in shares below 2 reais

As we talked about at the beginning, investing in stocks is not a big deal. Quite the contrary: choosing the right broker of your choice, the process is quite simple. Just open an account at the chosen broker and choose the shares below 2 reais to start trading.

After a market analysis, following different opinions, we came to the conclusion that one of the best platforms for new investors is the eToro. To make it easier, we've brought you a step-by-step guide for you to see how easy and fast it is to start investing with this broker!

Step 1: Create an account on the eToro website

When entering the eToro website you will already be faced with a button to “try” the tool, and from that, a registration page is displayed. You can register either manually or using the Login information with your Google or Facebook account. If you already have the account, just click on the “Login” button.

The requested data are:

- Full name;

- Email address;

- Your preferred currency (Dollar, Euro or Real);

- If you agree with the terms of contract and privacy policy.

Step 2: Fill in your personal data and complete your profile

To bring more practicality and clarity to operations, as soon as you create the account, eToro takes you to a quick and intuitive tutorial in the tool itself, totally based on your experience. In addition, you will need to complete and validate your profile. After finishing the tutorial, you will already have access to the demo and real accounts. Just click on the button that says “deposit” to be taken to the payment methods page.

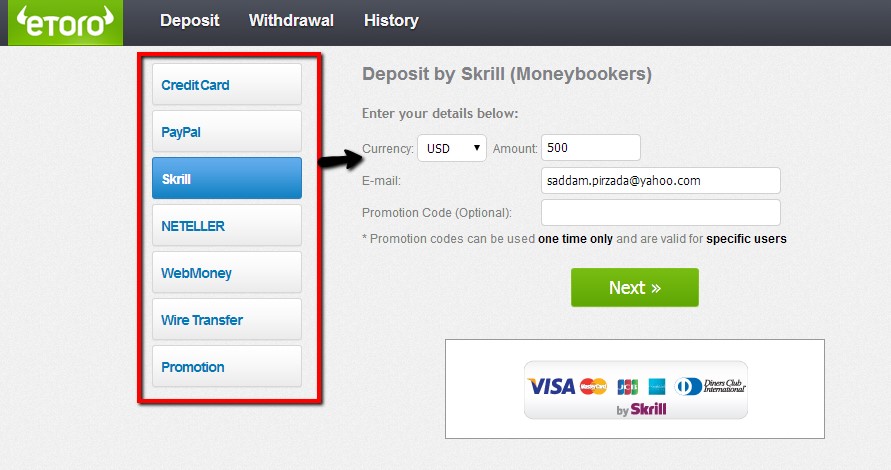

What payment methods does eToro accept?

eToro is one of the most complete and flexible platforms on the market today – and for that reason it attracts a lot of attention from investors around the world. It accepts the following payment methods:

- Pix

- Wire Transfer

- Ticket

- Lottery

- Neteller and Skrill

- Itaú, Banco do Brasil, Bradesco and Santander

- AstroPay and Safety Pay

- Perfect Money

- Bitcoin and Litecoin

- Jeton wallet

- Advcash

Step 3: Make a minimum deposit

Now that you know the many options eToro has for you to make a deposit, let's put it into practice! To start trading, it is important to open a virtual wallet on the platform. For this, it is necessary to make a minimum deposit, the amount is usually quite low!

You choose the payment method, make the deposit and the amount will be debited to your account. We suggest starting with an amount ranging from R$40 to R$200 to understand how the platform works.

Furthermore, an important and advantageous detail: it is also possible to count on an “eToro coupon”.

Step 4: Start investing

Once the deposit has been made, just click on the button that says “trade” and go to the trading interface. eToro offers some ways to ensure that all users have equal opportunities and that they fit the individual investor profile.

6 shares below 2 reais today to start investing

Now that you know everything about the stocks below 2 reais it's time to know what they are. We remind you that it is important to do the individual analysis of the one you want to buy, if your wish is that they are capable of yielding some good – after all, we know that some people like to invest to get “practice” in the financial market.

We like to give this warning because even a stock with a low value runs the risk of falling further. Below, check out the 9 shares quoted for less than 2 reais:

1- Recrusul (RCSL4) - BRL 1,67

2- Dommo (DMMO3) - BRL 0,87

3- Saraiva (SLED3) - R$ 0,89

4- Hail (SLED4) - BRL 0,52

5- OI (OIBR3) - BRL 1,09

6- OI (OIBR4) - BRL 1,75

Data were collected in August 2021

Shares below 2 reais 2020

Understanding the financial history and knowing which stocks were cheap in the past is a way of understanding the present and thinking about strategies, especially if it is the case of a company that is already valued again, even if a little more.

2020 was a very unusual year for most companies. Many went bankrupt and others had serious financial problems. So, this also meant the fall in the price of many stocks. The good news is that many of these companies that were priced below 2 reais had a certain appreciation in 2021. Therefore, those who bet right managed to still earn income with cheap shares.

Below, check out a list of companies that closed 2020 as the cheapest shares and below 2 reais:

- Saraiva (SLED4) - BRL 0,64

- Dommo (DMMO3) - BRL 0,88

- Saraiva (SLED3) - BRL 1,13

- Living (VIVR3) - BRL 1,25

- Technos (TECN3) - BRL 1,27

- Dommo (DMMO3) - BRL 1,35

- JB Duarte (JBDU4) - BRL 1,35

- Tecnosol (TCNO4) - BRL 1,50

- Hi (OIBR3) - BRL 1,54

- Recrusul (RCSL4) - BRL 1,67

- BR Brokers (BBRK3) – R$1,8

- Haga (HAGA4) - BRL 1,97

- Santanense (CTSA4) - BRL 1,97

Why does the stock price fluctuate?

Stocks are representations of how investors are viewing a company. The more investors, the greater the value of its price. Therefore, the appreciation of a stock means the increased interest on the part of investors to put their money there.

In times of financial crisis or great volatility in the financial market, such as what happened in 2020 with the closure and indebtedness of many companies, it is common for the share price to be even more volatile.

In general, the interest in buying and selling shares is related to the segment in which the company operates, whether it is a business that is on the rise or not. We can see this clearly by analyzing the shares of the Saraiva company (SLED4). With the book market being replaced by the Amazon phenomenon (and other factors as well), the company is now one of the cheapest shares in all of B3.

The country's economic situation also impacts stock prices, as well as political and social events. Even an event that occurred in other countries can represent a variation in the cost of an investment.

How can stocks below 2 reais appreciate?

We often see companies that are publicly traded through IPOs with very low share values. Many of these companies are even Startups. Appreciation takes place in different ways. Among them, if future projects are in accordance with the roadmap and path that the company follows after going public, as well as the revenue that the company has. A company that doesn't have big projects ahead, and that doesn't increase its income or works on its expansion, in a certain way, won't be able to appreciate the value of its shares.

FAQ

What are the best stocks below 2 reais to invest?

There are many actions to choose from. Among the Brazilians, the ones that we usually have our eye on are OI (OIBR) and Saraiva (SLED3).

Are there shares below 2 reais that appreciated today?

Yes, there are many Brazilian actions that started below 2 reais and are now worth a lot. One of the best examples is Magazine Luiza Shares (MGLU3), which in 2021 are traded above R$20,00.

Are there shares below 2 US reais to invest?

There are several stocks below 2 reais on the American stock exchange NYSE and NASDAQ. A good example is Gran Tierra Energy (GTE) and Two Rivers Water & Farming Co (TURV).