Are startup stocks worth it? Check out the best ones to invest

The startup model is becoming popular in Brazil. Currently, the country already has 20 unicorns, that is, companies with a market value equal to or greater than US$ 1 billion – which corresponds to more than R$ 5 billion at today's dollar exchange rate. For this reason, invest in startup actions is becoming an attraction for many young people and modern investors.

index

Young people of virtually all age groups, especially those aged 16 to 35, are investing more in fixed income. This is what reveals a Study of the Stock Exchange, B3, compared to recent years. Just to give you an idea, the number of new investors aged 16 to 25 years rose from 37.766 in 2018 to 166.353 in 2019. A significant leap also took place between 26 and 35 years, which by 2018 amounted to 186.593 investors and, until the At the end of 2019, B3 closed with 498.771.

With this arrival of a more technological public, aware of the main market trends, buy shares startups has become a very interesting option that new marketers are considering. After all, they are innovative companies with ideas that are out of the box and that they can appreciate very quickly.

Some of the startups that became unicorn in Brazil you've certainly heard of and will motivate you to start investing in this market right now. Below is the complete and updated list of these companies:

- 99

- XP Investments

- food

- gympass

- Insurance Pay

- Nubank

- Stone

- Brex

- Loggi

- Fifth floor

- ebanx

- Wildlife

- Loft

- Vtex

- Credits

- Hotmart

- WoodWood

- Unique

- ascenty

- Arch Education.

But after all, what is a Startup?

The startup is a company model recognized for its youthful, scalable and innovative appearance. It is generally a business with high technological maturity that brings ideas and action plans out of the box to solve a problem that today “has no solution” – or if it does, it is not the most suitable, cheap or practical.

Some startups you already know and maybe even use their services like uber and 99. The two companies emerged as a cheaper way to offer quality transport to anyone and “anywhere” (at least, where the application is regulated ). Within a few years, the two companies became unicorns. The same happened with Ifood, which revolutionized the delivery market in Brazil.

These companies are definitely trends in the business field, and, in relation to the financial market, startup actions have been attracting the attention of investors. Although they represent a greater risk, as they are financially more unstable than a company already consolidated in the market, there is always that expectation that the product will be revolutionary and the shares will appreciate very quickly.

Just imagine who managed to invest in Uber, 99, Ifood or any of the 20 Brazilian unicorns when they were “under”? The shareholder certainly did not regret the decision. Still in this content, we'll give you some tips on how you can assess whether or not it's worth buying a startup's shares.

We remind you that this type of market analysis is always essential, whether for investments in the stock market or when buying startup shares. Next, we will understand the differences between these two models of buying and selling assets.

How to buy startup shares? Know advantages and disadvantages

It's clear that startups are truly innovative business models. And when you want to buy shares at a more competitive price, they can be viable options. But after all, how does buying startup shares work?

It is important for you to know that as well as buying shares on the stock exchange, startups' assets are also for variable income, which, in practice, means that you receive an equity interest in the profits of the invested company.

The main difference between investing in the stock market, in the famous "blue chip“, and in startups it is precisely at risk, both for high and for low. After all, the more traditional and established companies in the market tend to have volatile stocks, but generally remain at a stable level. Startups, on the other hand, have a more immediate nature and, at any time, depending on the business segment, they can go through the boom.

Another point that sets assets apart is related to their return on investment. While a share of traditional companies listed on B3 can value faster and make profits in a short time, a startup can take more than 4 years. However, the gain tends to be much greater.

The movement of Brazilian startups entering the IPO is new, and it intensified last year with the increase in the number of Brazilian investors. The main highlight for these assets that catches the attention of shareholders is the low cost of the shares compared to financial market blue chips.

Benefits

- Most affordable share price;

- Great chances of long-term appreciation;

- Good profitability;

- Low competitiveness.

Disadvantages

- Longer return on investment;

- Increased risk of devaluation.

That's why, more than any other asset, it's essential to keep an eye on the startup you want to invest in, analyzing the history, the achievement of goals and whether the business motivations are in accordance with the market's needs.

Step by step to buy startup shares with an exchange

With the arrival of startups at the IPO, there is that question about how to acquire the shares. The purchase of the assets of these innovative companies can be done through exchanges such as eToro, which is the best Bitcoin and other stock broker in Brazil.

The company offers modern options for buying startup shares, either by credit card or even with PayPal.

Simple and intuitive, eToro's platform has excellent usability, which facilitates trading in trading to buy startup shares. Oh, and the best thing is that the user can transfer the assets to their custody portfolio in the tool itself. Below, see how easy it is to buy stocks by following our walkthrough:

1- Create an account on the eToro website

If you want to enter the world of startup stocks, you must first create your account on the eToro website. It's very simple, just access the site main page who already have all the necessary information for your registration.

After that, you will need to verify your identity, which is a normal brokerage process to avoid system fraud. This is known as KYC (Know Your Customer). It serves to prevent users from using brokers in illicit ways to launder money. The verification is very simple to be done, you will only need a document with a photo (RG, CNH or Passport) to complete the registration.

Despite being an international platform, it operates in the Portuguese language to facilitate Brazilian users.

2- Make the first deposit

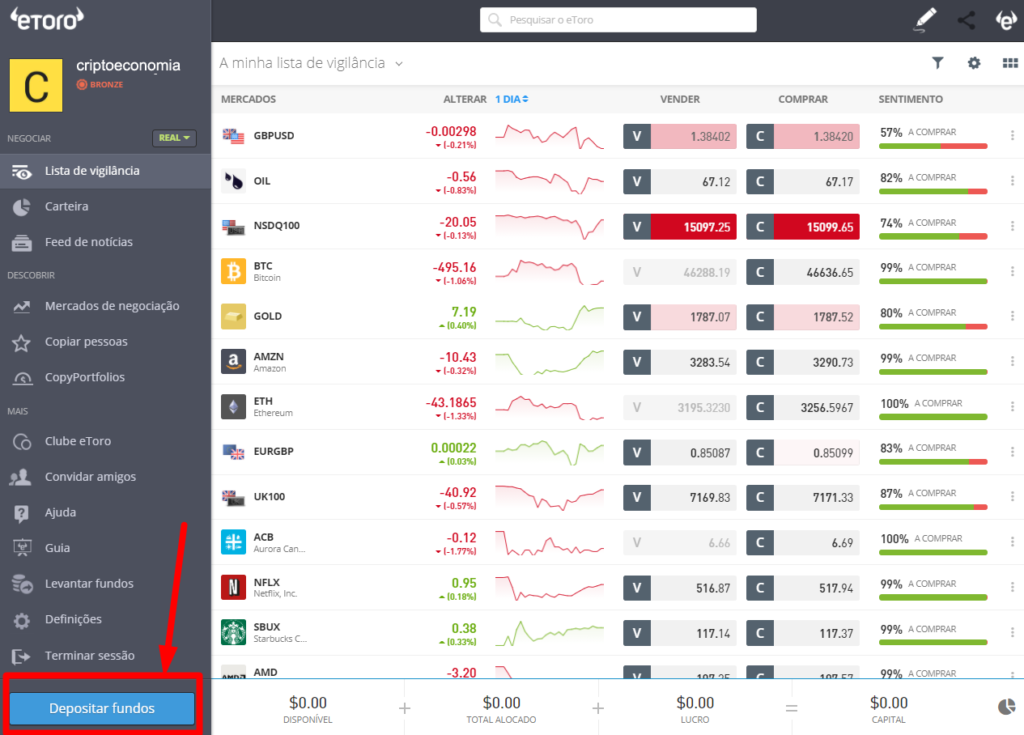

With the registration complete, the time has come to “prepare the ground” for the purchase of shares. To do this, you need to make a first deposit with eToro. Just click on the option that says “deposit funds” and add a balance to your account.

The minimum deposit amount is $50 USD, R$265 at the current quote. This is a value that guarantees the safety of the assets you will buy and keeps them safe in your virtual wallet. The platform offers different payment methods such as credit, debit, paypal and many others. Just choose and click “continue”.

Unfortunately eToro doesn't have PIX yet, but that's just a matter of time. After depositing the desired amount comes the best part: buying the startups' shares.

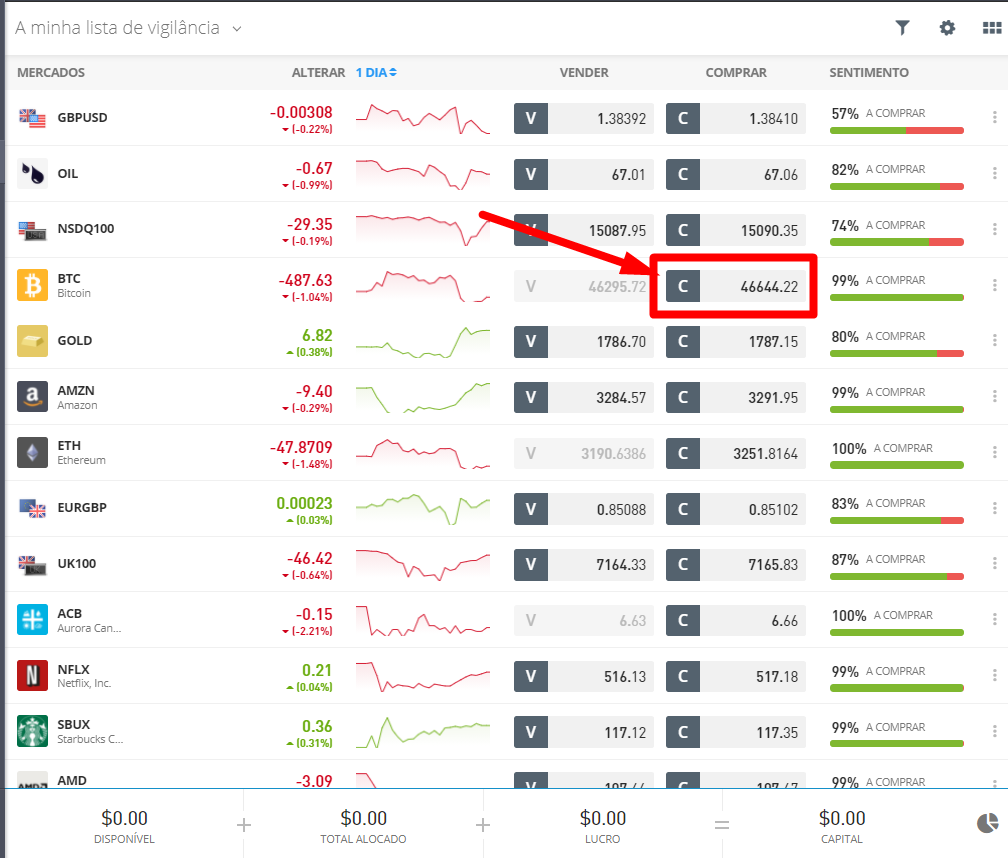

You have access to a “Watch List” that offers a stock income status as well as the option to make a purchase. Below is an example of buying BTC in the tool – the process for startup shares is pretty much the same.

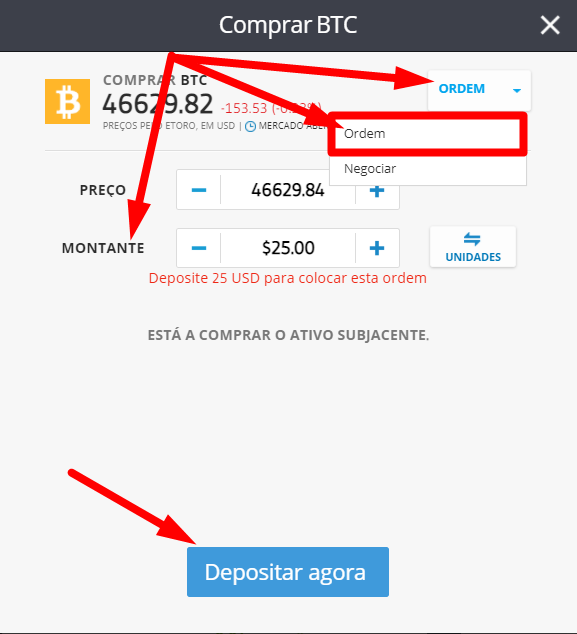

After selecting the desired asset, just click on “buy” and, on the screen that will open, you can choose the amount you want to invest in the stock. An important detail can be seen in the image below, which shows the ways eToro has to open a trading order: either by the famous “Trade” or by buying the adjacent asset.

After completing this step, you already have your share purchased!

The entry of startups in the stock market

If you followed the reading so far, you already know that since 2020 many startups have opted to enter the financial market to get new investors. The idea was very pleasing to shareholders who are able to buy shares more easily, as well as companies that have greater financial support to meet their goals.

But how did this movement get started?

The startup market saw a welcome and advantageous opportunity to be publicly traded. After all, these are companies that need a lot of investment to put into practice their development plan and have scalable growth.

The stock market entry comes at a good time to help these startup entrepreneurs gain their autonomy more quickly and, who knows, reach the mark of a unicorn. The IPO is a list of shares available for investors to buy assets, and for a startup, being listed is a strategy of visibility for your business, as if it were a showcase to attract new partners.

This milestone dramatically changed the way startups get new investors. In the past, there were only two more common options: investment funds and angel investor. With the entry of these companies in the financial market, the gain ends up being much greater.

In the end, it's a scenario that pays off for both the investor and the startup. On the one hand, the company has a faster growth because it has more money for its strategies, and the investor, in the same wave, a return in a shorter term.

The increase of individuals on the stock exchange is a great motivator, after all, they can be partners in a startup and directly contribute to the growth of the business. The advantage for companies is having more autonomy. Generally, angel investors want to be more active in decision making, especially when injecting capital. In the case of fundraising through the IPO, this is not a rule, as the company will not necessarily have direct contact with the investor.

Tips for buying startup stocks

The financial market has reacted well with the arrival of startups in the dispute for shareholder interests. After all, it is not only advantageous for the startup to have more visibility, it is also a great benefit for shareholders to have more options available for investment.

Generally, the share price of a startup that has just entered the IPO is low. That's because the company is just beginning its journey into the market. The advantage of investing in these assets, with little competition, but which present innovative ideas and are correctly following the proposed roadmap, is precisely that when they appreciate in value, the profit will be abundant.

Whenever a new company goes public, investors' eyes shine. If the company is in high demand, the value of the shares tends to go up, and if competition is weak, the startup could rise at any time and present gains for the few shareholders.

Remember that we guided you to make an analysis of the company's history was essential? Well then! When we talk about startups, you need to be twice as careful, but the good news is that companies are forced to open their financial and strategic plan.

That way, if you want to buy startup shares, you'll be pleased to know that they issue a certificate to GVC – Brazilian Securities Commission, which is available for consultation. The documentation has information such as:

- Company financial data;

- Action plans;

- Risk factors;

- Activities that will be carried out with the funds raised.

It is a way to provide more tranquility to shareholders and transparency in relation to the destination of the fund being invested – it avoids corruption and money laundering.

A tip worth following is precisely to understand if the company is aligned with these purposes and if it is making the best decisions according to the current market situation. Evaluating these points and finding the right startup, the chance of a return is very big.

Startup IPO: see which companies to invest

The movement of startups entering the IPO started between 2017 and 2018 in a more timid way. Although this trend is in its infancy, in 2020 four new companies entered the financial market. By the end of 2021, the expectation was to reach between 5 to 10 new companies in the IPO (the number has already been surpassed).

These are the main startup actions, with updated price, listed in the IPO:

- PagSeguro (PAGS34) - BRL 60,29

- Stone (STOC31) - BRL 265

- Locaweb (LWSA3) - BRL 22,60

- I got sick (ENJU3) - BRL 6,48

- Mobly (MBLY3) - BRL 11,90

- Meliuz (CASH3) - BRL 45,41

- Bemobi (BMOB3) - BRL 19,47

- GetNinjas (NINJ3) - R$ 12

- Zenvia (ZENV) - BRL 12,27

- Airbnb (AIRB34) - BRL 38,57

- Alibaba (BABA34) - BRL 33,54

Data from August 18, 2021*

As you can see, some of the startups' shares are already well valued (as in the case of Stone) and others are still conquering their space. Therefore, buying stocks, especially the cheaper ones, can be a good investment if the company is following the delivery roadmap correctly.

In addition, many of these companies are standing out more and gaining visibility. An example of this is Locaweb, which, at the beginning of the year, had a high valuation of its shares with the possibility of buying the company RD Station. Despite having lost the opportunity in the dispute with TOTVS, the largest Brazilian technology company, the repercussion generated visibility and the shares remained with a high average compared to the last 12 months:

In other words, those who bought the shares of this startup at the end of 2020 had a good return in 2021 – which shows how much the entry of these innovative companies in the IPO reduces the time to payback on the amount invested. In addition, Locaweb was the largest Brazilian IPO in 2020.

The company offers hosting and creation of websites and other services over the internet. With the pandemic and the increase in electronic stores (e-commerces), the growth in the market value of this startup is very well justified.

Some other startups have already shown interest in entering the financial market, and may be good bets to keep an eye on this year, such as PicPay and Nubank, two financial market giants that, if they really enter, promise to move the scenario a lot for investors .

Nubank even announced that Easynvest will change its name to “Nu Investe”, while the company prepares for the IPO in 2021 at Nasdaq.

As we could see, startups offering financial services are one of the most powerful to become unicorns, so market expectations for Nubank's arrival are quite positive.

Is this a good time to invest in startups?

Brazil has gone through turbulent times as a result of the Coronavirus pandemic. Many companies in 2020 saw their shares fall dramatically, not to mention the many companies that went bankrupt.

However, 2021 seems to be the year of economic recovery for companies, many of them appreciated and the market is boiling with new opportunities. Startups, being visionary and innovative companies, are already starting to think about new products and business models to adapt to this new reality (the so-called “new normal”) that Brazilians are going through.

In addition, the digital market grew a lot from 2020 to 2021, which represents a greater number of consumers having their first contact with a startup. The chances of stock appreciation are very high.

FAQ

What are the best startup stocks to invest?

There are many startups to invest. Among those that stood out best in 2021, Track&Field (TFC04), Petz (PETZ3).

Which Startups Should Make an IPO in 2021?

Some of the companies that applied to make an IPO and that we should keep an eye on are Smartfit (SMFT3), Dotz (DOTZ3) and ModalMais (MODL11).